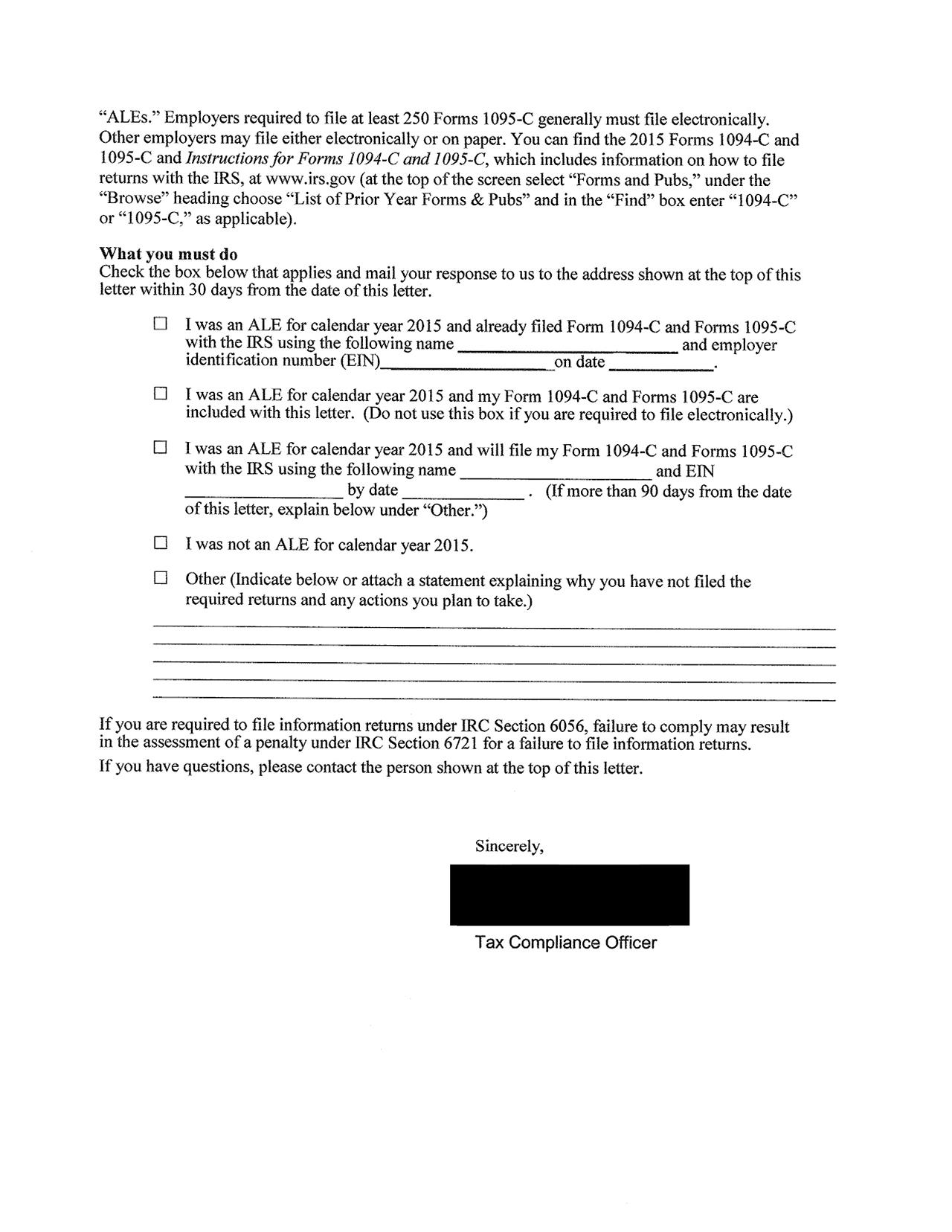

IRS Forms 1094C & 1095C Compliance Training Fact Scenarios Scenario 1 • Employer (Acme Consulting, Inc) has 1 F/T employees working on average 30 or more hours per week o Employer has 2 0 P/T employees working hours per week Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 16, Forms 1094C and 1095C are required to be filed by , or , if filing electronically" The IRS has started issuing new penalty notices to employers that failed to file forms 1094C and 1095C with the federal tax agency or furnish 1095C forms to employees for the 17 tax year as required by the Affordable Care Act The IRS in January began issuing penalty notices to employers under IRC 6721/6722 for the 15 and 16 tax years

2

Irs form 1094-c 2017 pdf

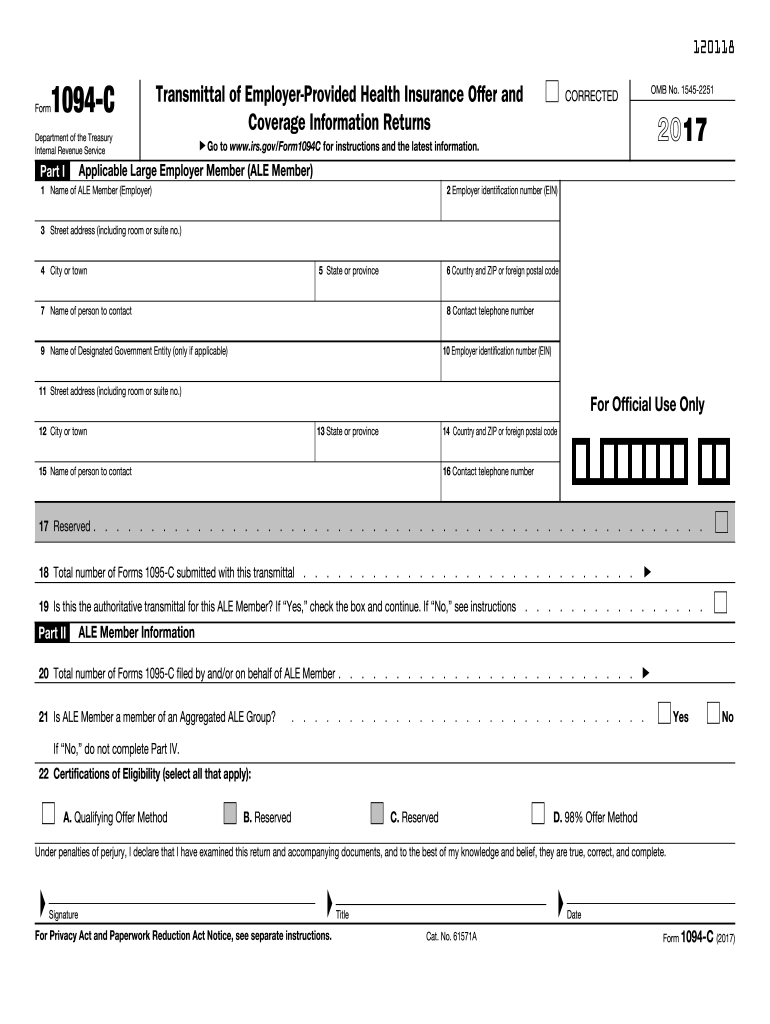

Irs form 1094-c 2017 pdf-Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2IRS Reporting Tip 2 17 Plan Year Form 1094C, Line 22 Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their fulltime employees In order for the Internal Revenue Service (IRS) to verify that (1

Www Lawleyinsurance Com Wp Content Uploads 18 11 1095 C Final 18 Forms Pdf

The IRS has released the final Forms 1094B, 1095B, 1094C, and 1095C for calendar year 17 reporting Employers are required to report in early 18 for calendar year 17 You can find the forms for calendar year 17 reporting here 1094/1095B Instructions 17 Form 1094C 17 Form 1095C The IRS has issued the filing schedule for reporting ACAmandated employee data for the 17 tax year The agency is expected to start sending notices of penalty assessments by the end of the year for those companies who did not comply with ACA provisions and IRS filing requirements for the 15 tax year17 1094 C Fillable Form Fill out, securely sign, print or email your 1094 c 17 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

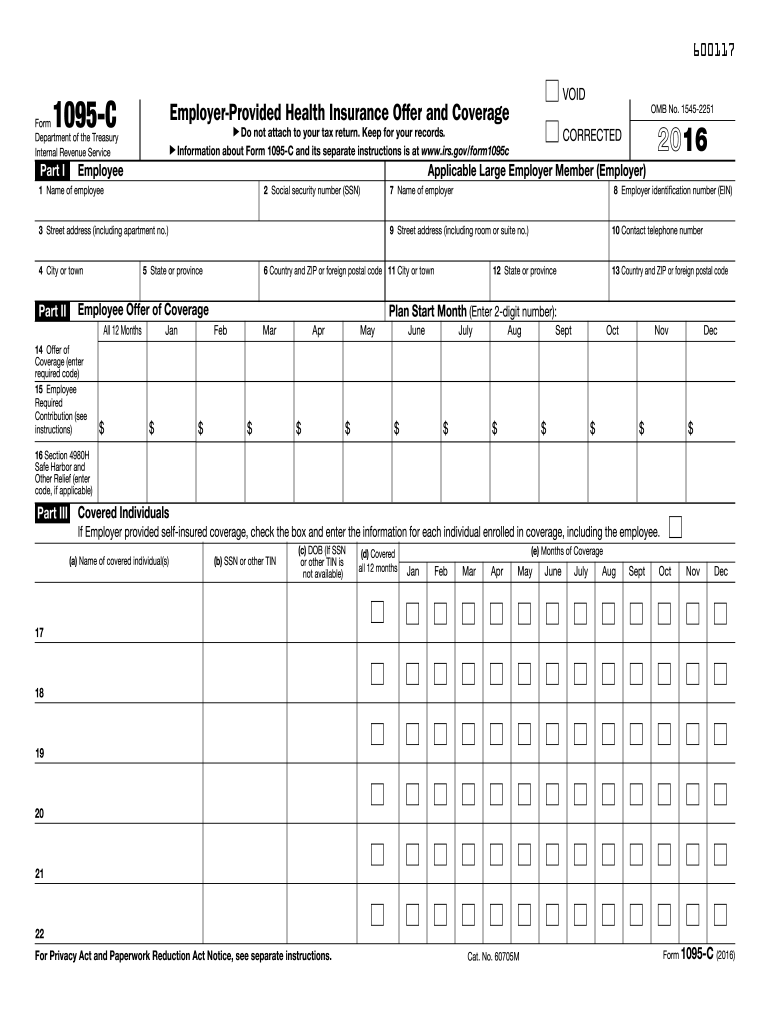

The Form 1094C, or Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, is like a cover letter for the Form 1095C In other words, you only send one It provides basic employer information and the number of 1095Cs your company is submittingThe IRS released revised versions of Form 1094B, Form 1094C, Form 1095B and Form 1095C to use for 17 reporting under the Affordable Care Act Form 1095B/C is required to be furnished to individuals byEmployees must receive their copies of form 1095C and the written statements by March 2nd The IRS must receive forms 1094C and 1095C by February 28th, 17 (if filed by mail) March 31st, 17 (if filed electronically) Final Tips Show the IRS that you're ACA compliant by correctly filling 1094C and 1095C on time

The forms and instructions are largely unchanged from 17 The Plan Start Month box continues to be optional on Form 1095C for 18 Parts I and III of Form 1095C include separate fields for each individual's first name, middle initial, and last name, rather than a single blank for the individual's full nameThe 17 forms (ie, forms reporting calendar year 17 information) were due as follows 17 Form 1095C (employee statement) Due 17 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines

Aca Information Reporting On Forms 1094 And 1095 B C Getting Ready For 17 Webinar Youtube

2

In October, the Internal Revenue Service (IRS) published updated versions of Affordable Care Act Forms 1094C and 1095C, as well as the instructions for how to complete the forms for tax year 17 Forms 1094C and 1095C are used by Applicable Large Employers (ALEs) to report on employerprovided health insurance offers and coverageTitle Cat No A Date Form 1094C 17 Page 2 a Minimum Essential Coverage Offer Indicator b Section 4980H FullTime Employee Count for ALE Member c Total Employee Count for ALE Member d Aggregated Group Indicator All 12 Months Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 1316 Page 3 Other ALE Members of Aggregated ALE Group Enter For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically

Www Calpers Ca Gov Docs Circular Letters 17 600 070 17 Attach1 Pdf

2

17 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage 19However, in certain circumstances, the Form 1094C can be submitted alone After these forms are processed by AIR, the status of eachAll of this reporting is done on IRS Forms 1094B, 1095B, 1094C and 1095C Final instructions for the 1094B and 1095B and the 1094C and 1095C forms were released in September 16, as were the final forms for 1094B, 1095B, 1094C, and 1095C The reporting requirements are in Sections 6055 and 6056 of the ACA Form 1094C

2

Affordable Care Act Reporting Tips Irs Forms Dc Risk Solutions

Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16I am sure you all have been eagerly awaiting the issuance of the 16 Affordable Care Act (ACA) forms (1094C & 1095C) and draft instructions Under the ACA, Applicable Large Employers (ALEs) will complete and file these forms in early 17 (don't assume the deadline will be extended again this year) to report to the IRS coverage offersForm 1095C (17) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provision in the Affordable Care Act This Form 1095C includes

Irs Begins Aca Penalty Collection Process Under The 4980h Employer Shared Responsibility Rules Woodruff Sawyer

2

1095 C 17 Forms Fill out, securely sign, print or email your 1095 c form 17 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!In the Process Payroll Tax Forms screen, select 1095C from the Form type dropdown list In the Year dropdown list, select the year for the 1094C and 1095C forms you want to process and then click the Refresh button Use the Filter Options section to limit the clients and forms that display in the Form Selection grid The 17 Form 1094C and all supporting Forms 1095C (collectively, "the return") is due to the IRS by if filing electronically (or if filing by paper) These deadlines were not extended as part of the relief announced in Notice 1806 Per the Notice, the government determined there was no similar need

Http Product Ftwilliam Com Wp Content Uploads 17 10 Kr600 Ftw 1094 1095 Sell Sheet Fnl Pdf

2

For calendar year 17, Forms 1094C and 1095C are required to be filed by , or , if filing electronically See Furnishing Forms 1095C to Employees for information on when Form 1095C must be furnished Are 1095 forms required for 17 taxes? Form 1094C A box in Line 22 called "Section 4980H Transition Relief" has been removed It is not applicable in 17Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronically

Www Irs Gov Pub Irs Prior Ib 17 Pdf

2

The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available) Last week the draft instructions to the Forms 1094C and 1095C were released with minimal changes compared to the final instructions from 16 Most of the changes made in the draft instructions are the elimination of discussions related to the transition relief provisions that applied in previous years, but can never apply for the 17 FormsForm 1094C, attaching Forms 1095C for each of its 100 fulltime employees This Form 1094C should be identified as the Authoritative Transmittal on line 19, and the remainder of the form completed as indicated in the instructions for line 19, later Example 2 Employer B, an ALE Member, files two Forms

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

2

And the Forms 1095B and 1095C provide information about the covered individuals Generally, the Forms 1095B and 1095C will be submitted with their associated transmittals, Forms 1094B and 1094C; Feb 28, 17 Forms 1094B, 1095B, 1094C and 1095C due to IRS if filing electronically* * Any employer filing 250 or more information returns during the calendar No transition relief is available for 17 Form 1094C, line 22, Box C is designated as "Reserved" Form 1094C, Part III, column (e) is designated as "Reserved" and the entry rows in the column are shaded Furnishing and filing deadlines for 17 forms Furnishing deadline for Forms 1095C to employees

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

Aca Reporting And The Irs What To Know About The Letter You Received The Aca Times

Making Corrections to 1095 C & 1094C of the 1094C, 1095Cs, XML file and IRS acknowledgments • A best practice would be to download this package and save in electronic form 24 Data Retention PackageIf you are filing Form 1094C, a valid EIN is required at the time the form is filed If a valid EIN is not provided, Form 1094C will not be processed If you do not have an EIN, you may apply for one online Go to IRSgov/EIN You may also apply by faxing or mailing Form SS4, Application for Employer Identification Number, to the IRS How to Print a 1094C 1) Select Print Forms from the menu bar then select Print Forms from the dropdown 2) Select the payer/company from the Company dropdown 3) Select the form type from the Form dropdown 4) Select the employee from the Employees available to Print window 5) Select printing Option, (Preprinter or Laser generated) → Select Print Copy (

2

Form 1095 A 1095 B 1095 C And Instructions

The Affordable Care ActReporting Requirements A StepbyStep Guide to Form 1094C 1 2 These slides were last updated on 2 3 First things first, this is not a basic guide 3 4 This guide assumes you know how the Employer Mandate basically works under the Affordable Care Act 4 5Draft IRS ACA Reporting Forms for 17 Are Out, Transition Relief for Companies Is Over Robert Sheen The IRS has released drafts of forms 1094C and 1095C for use in reporting ACAmandated information for the 17 tax year You can view the draft forms at IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the

Www Lawleyinsurance Com Wp Content Uploads 18 11 1095 C Final 18 Forms Pdf

2

Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 17 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2•YearEnd Close created IRS Forms 1094C and 1095C •You are clicks away from filing •Check to see if you need to do any editing for the 1094C •You may be part of a controlled group where another entity processed their own returns You still need to reference them in Part IVReference Guide for Form 1094C, Line 22 What's With These Questions About the Qualifying Offer Method and the 98% Offer Method?

Filing Form 1094 C Youtube

Www Irs Gov Pub Irs Prior F1094c 17 Pdf

See page 15 of form instructions for more information 17 For IRS use, skip this line 18 Enter the total number of 1095C forms submitted with this 1094C form Unless you are submitting 1095C forms in batches and using multiple forms 1094C this number will generally correspond to the total number of 1095Cs you are submitting overallIf you are expecting to receive a Form 1095A, you should wait to fileForms 1094C and 1095C are IRS forms that employers must file if they are required under the Affordable Care Act (ACA), or Obamacare, to offer their employees health insurance8 min read

2

Irs Q A About Employer Information Reporting On Form 1094 C And Form 1095 C California Benefit Advisors Johnson Dugan

November 17 • Lockton Benefit Group L O CKT O N CO M P ANIES FOLT, Senior Vice President Director of Compliance Services Locton Benet roup efensholt@locktoncom AUTHORS A MAACA, C Vice PresidentAfter revise the document, you are free to print, download, and send the form If you have any misunderstanding, please communication with the support team to acuqire more details By deploying CocoSign, you can fill in 1094 C 17 Form and write down your digital signature soon –The due date for filing with the 17 Form 1094B, Transmittal of Health Coverage Information Returns, and Form 1095B, and the 17 Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, and Form 1095C with the IRS remains unchanged The due date is ;

How To Respond To Irs Letter 226j For The 17 Tax Year Infographic The Aca Times

Form 1095 A 1095 B 1095 C And Instructions

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

2

2

2

2

2

1

Prepare For Early 18 Aca Information Reporting On Health Coverage

2

Affordable Care Act Lessons Learned Ppt Download

What You Need To Know About Aca Penalties Irs Tax Assessments Tango Health

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

2

Form 1099 Nec Requirements Deadlines And Penalties Efile360

2

Prepare For Early 18 Aca Information Reporting On Health Coverage

1

When To Expect Your W 2 1099 More Tax Forms In 17 And What To Do If They Re Missing Tax Forms Irs Tax Forms Student Loan Interest

Form 1095 C 17 Fresh Irs Form 62 For 14 People Davidjoel Models Form Ideas

2

Form 1095 C 17 Fresh Irs Form 62 For 14 People Davidjoel Models Form Ideas

Editor S Choice 17 Esc Guidelines On The Diagnosis And Treatment Of Peripheral Arterial Diseases In Collaboration With The European Society For Vascular Surgery Esvs European Journal Of Vascular And Endovascular Surgery

2

Www Irs Gov Pub Irs Utl Instructions for ty17 criteria Based aats scenarios Pdf

Csqa Thomson Com Ua Acct Pr Acs Cs Us En Pdfs Acs Payroll Ye Faqs Pdf

2

Www Irs Gov Pub Irs Utl Known issues ty17 aats predefined Pdf

2

Fresh Form 1095 C 17 Models Form Ideas

2

17 Irs Reporting Requirements Babb Insurance

U S Affordable Care Act Aca Information Reporting 16 Sap Blogs

Aca Reporting Services Dayforce Ceridian

2

2

Affordable Care Act Lessons Learned Ppt Download

Www Alliantbenefits Com Media 1345 Alert 17 11 Amended Filings In The Era Of Esr Penalties Pdf

Pdf Adenosine a Receptors Are Up Regulated And Control The Activation Of Human Alveolar Macrophages

2

Form 1095 C The Aca Times

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

2

2

Express Irs Forms Home Facebook

1

2

2

Form 1095 C 17 Fresh Irs Form 62 For 14 People Davidjoel Models Form Ideas

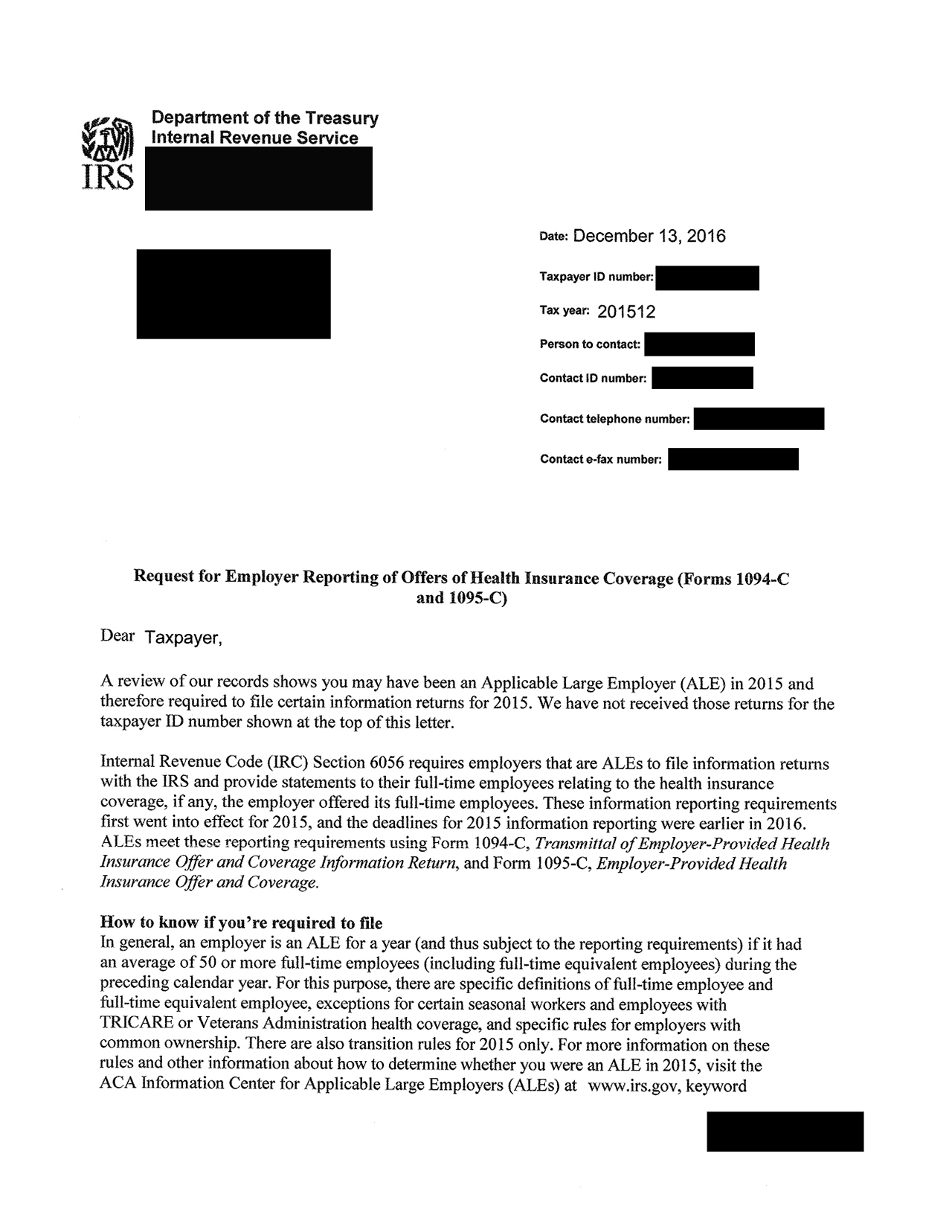

Worxtime An Equifax Company Irs Missive Seeks Out Non Filing Ales Noncompliance Aca T Co Su7mpsghyw

2

Www Irs Gov Pub Irs Prior F1095c 17 Pdf

Affordable Care Act Form Software Supplies Shops

2

Fill Free Fillable Irs Pdf Forms

2

Www Irs Gov Pub Irs Prior Ic 17 Pdf

Form 1095 C H R Block

Affordable Care Act Lessons Learned Ppt Download

2

Affordable Care Act Lessons Learned Ppt Download

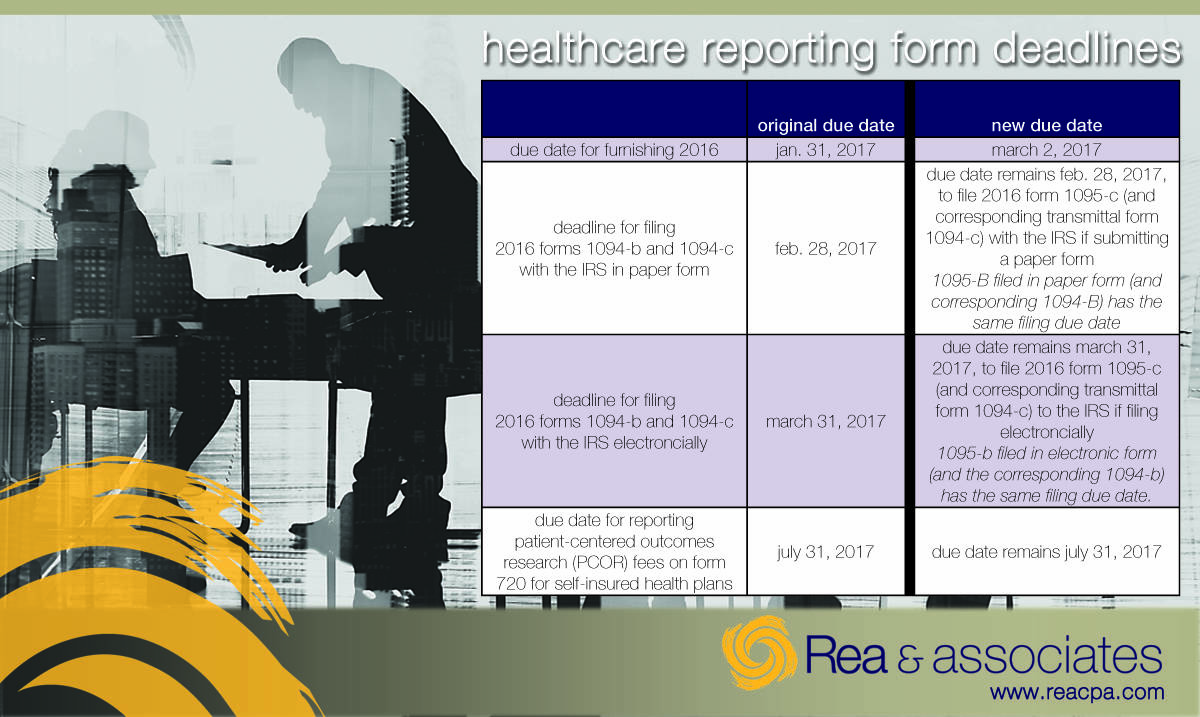

Healthcare Reporting Form Deadlines Rea Cpa

Form 1095 C 17 Fresh Irs Form 62 For 14 People Davidjoel Models Form Ideas

1095 Software Ez1095 Affordable Care Act Aca Form Software

2

1

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Proceedings Immagini Conference 17 Browse Articles

Affordable Care Act Lessons Learned Ppt Download

Does The Good Faith Effort Reprieve From Penalties Apply To Forms For 16 Filed In 17 Integrity Data

2

Www Uhc Com Content Dam Uhcdotcom En Healthreform Pdf Provisions Reform Reporting Requirements 6055 External Faqs Pdf

2

2

Aca Reporting And The Irs What To Know About The Letter You Received The Aca Times

2

Zortec Payroll Affordable Care Act Ppt Download

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

0 件のコメント:

コメントを投稿